In June we are happy to announce not only the upcoming summer, but also useful upgrades for our Clients in the areas of Invoicing, Trading, Instruments, and e-Documents. Please have a look at what our Product Team delivered for you this month and let us know your feedback!

Automated invoicing with WealthArc

In order to support the intense work of our Clients around Q1/H1 invoicing, WealthArc has released the next-generation fees and invoicing module (Management, Performance, and Agent Fees). It allows wealth managers to save time on calculating fees and generating white-labelled invoices by reducing the entire process to just a few clicks!

The most important enhancement is the “closing periods” functionality which allows users to:

- Freeze historic fee rates and calculations;

- Download accurate historic invoices;

- Take control of invoice numbering.

Below we take you thorough 3 easy steps to perform the “closing period” operation with WealthArc:

Step 1: Check the fee calculations

- When a new quarter begins, all portfolios are “Open”. This means their calculated fees may change, e.g. if you modify the Fee Rate or VAT Rate in the Portfolio Details view.

- When the portfolio status is “Open”, you can generate a preview invoice or fee details, which will show you what the target invoice will look like. Generating a preview will not increase the last invoice number.

Step 2: Close a portfolio to freeze values…

- Once you are certain that the calculated fee is correct, you can close the portfolio in the quarter. Click on the three dots to the right of the portfolio and select “Close Period”.

- After you refresh the page, the portfolio will change the status to “Processing”, during which fee parameters are being saved and the invoices generated in all formats.

- Once the process is complete, the portfolio will change the status to “Closed”. This means that the calculated fees and invoices are “frozen” and will not change in the future. You will also receive a notification with the generated invoice in a PDF file.

… or close multiple portfolios at once

- To make the invoicing process even quicker, you can select multiple “Open” portfolios and click on the “Close Period” button in the top right. After approving the action, please wait for the blue pop-up confirmation to appear.

- This will sequentially close all the selected portfolios and notify you once the process is finished.

Step 3: Once the portfolio is closed

- After the portfolio has been closed, you can easily download the archived invoice from the “three dots” or by selecting multiple portfolios and clicking on “Invoices”.

- If you need to correct an invoice, select the three dots to the right of the portfolio, and choose “Re-open quarter”. This will erase the frozen values and make the portfolio “Open”. Afterward, you can “close” the portfolio again, but it will then receive a new invoice number.

Trading

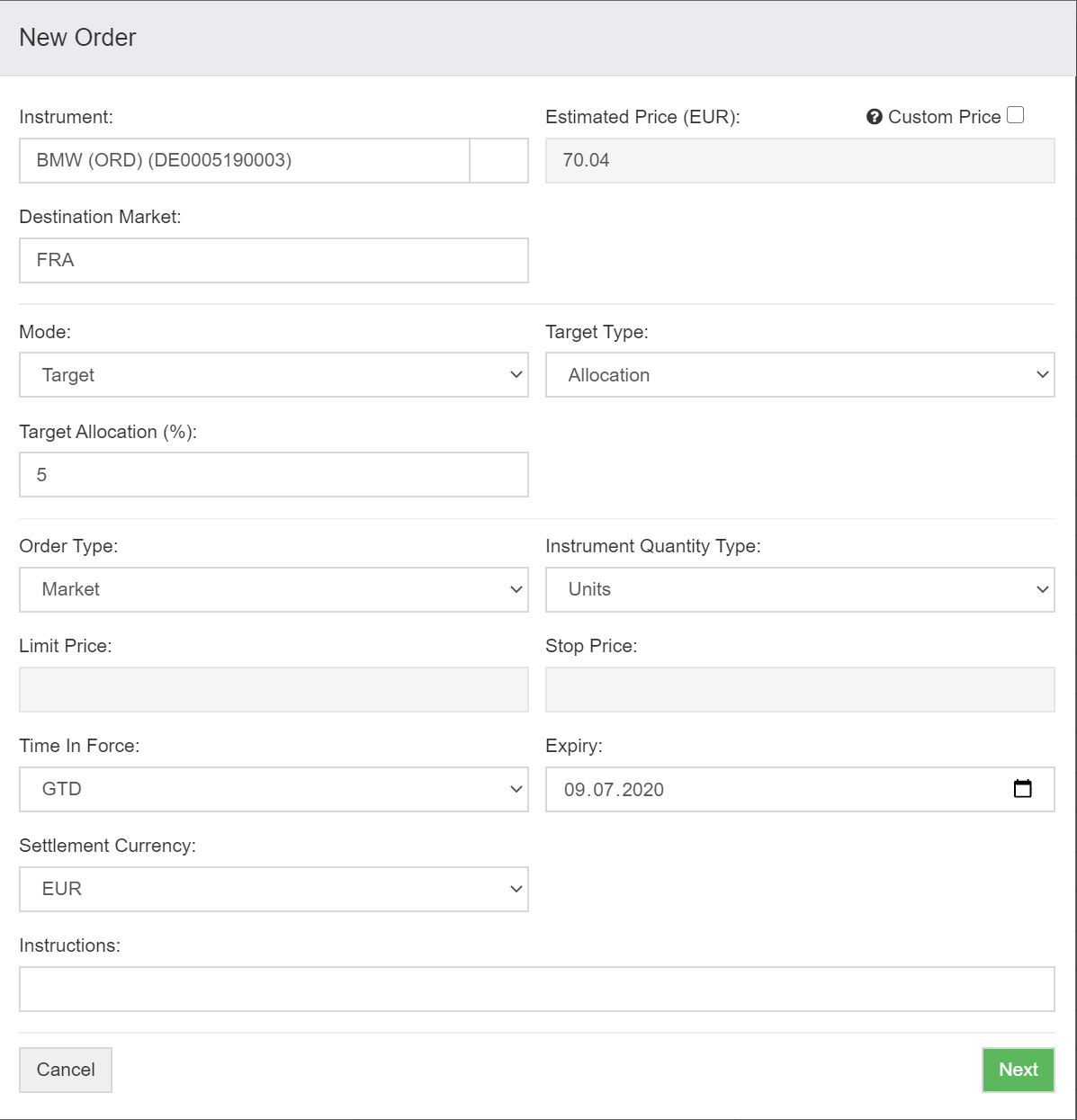

Making another step towards FIX direct trading in WealthArc, we have implemented new fields that are available when creating an order. Below You can find their detailed description:

- Settlement Currency – allows choosing in which currency to settle given order (which cash account to debit)

- Good till Date – new time in force option, giving a possibility to choose exact date and time for order expiration – necessary for limit and stop limit orders

- Destination Market – select desired exchange – needed for multi-listed assets

- Instrument Quantity Mode – determines whether the order quantity should be expressed in units or cash amount

As a minor improvement, we have also added “special instructions’ to the Orders Summary view – next to the portfolio name. This allows You to communicate specific guidelines like “Do not buy shares of X industry”. Its value can be set through the portfolio details view.

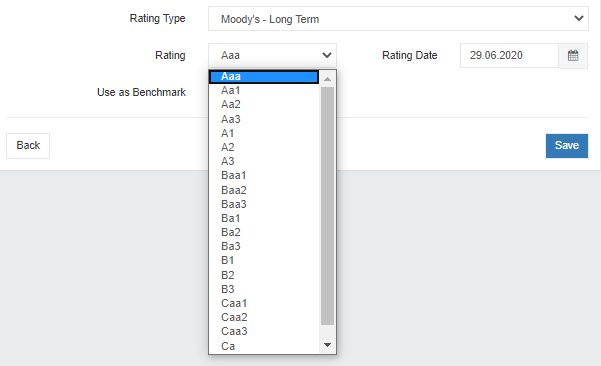

Instruments – Ratings

As a part of the instruments module enrichment, we have implemented an option to maintain ratings for instruments manually. You can now choose one of the three main rating agencies and a corresponding time horizon. For each of those groups, you will be able to select the current rating from the dropdown list. Ratings are available when editing instruments. In the upcoming release ratings will be also available as additional column in position views.

E-documents

E-documents have been now enabled for another custodian bank – Lombard Odier. We are not slowing down with the development and will continue our work on enabling the e-docs for more banks and will keep you updated on new additions!

%25201.jpeg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)